In early January, Amazon announced the expansion of their “Buy with Prime” (Buy With Prime) service to all eligible U.S. retailers. The program, which first launched as an invite-only beta in April 2022:

- Permits retailers to offer shoppers browsing their website an option to purchase products through their Amazon Prime account.

- Finalizes purchase with the payment information on file with Amazon, and Amazon fulfills the order.

And there are clear incentives to use the program for all parties. Shoppers save time in the payment process and trust Prime’s services to deliver their orders fast and free. Because of this, the retailer converts more sales. With these factors at play, Amazon stands to increase Prime subscriptions – and most consider that to be their main motive. But is it?

How Buy With Prime Is Challenging the Duopoly

While subscriptions are undoubtedly a factor, and maybe the main factor, this is a further step into the logistics space for Amazon.

Merchants have used Amazon to ship their orders through the Fulfillment by Amazon (FBA) program for years, but that was only available to 3rd party merchants selling on Amazon’s marketplace. By integrating Buy With Prime into their own website, merchants can shift nearly any volume from non-Amazon sales to Amazon.

Now, you don’t have to be FBA sellers to be eligible for Buy With Prime, meaning virtually anyone can sell and ship with Amazon.

What’s Driving Amazon To Compete With FedEx and UPS?

It’s no mystery that Amazon has been building a logistics network that matches the capabilities of FedEx and UPS. In 2013 and 2014, Amazon experienced, or narrowly avoided, peak season debacles with UPS, their primary fulfillment partner at the time. Following founder Jeff Bezos’ principle of obsessing over customer experience, Amazon executives realized that fulfillment being out of their control was a major threat to customer satisfaction and, ultimately, a threat to their business.

This, coupled with fulfillment being Amazon’s largest expense, led the eCommerce giant to invest in their own logistics network. They began investing in:

- Warehousing improvements

- Vehicle fleets

- Started Amazon air

- Acquired regional last-mile carriers

- And they established “Amazon Logistics,” a program to partner with independent delivery service providers for local fulfillment.

When experts predicted Amazon was building towards a logistics network that could potentially compete with FedEx and UPS, Amazon took the stance that they were simply looking to help lighten the capacity burden they put on their partner carriers. Today, they still remain UPS’ biggest customer.

The efforts have paid off. Per SJ consulting group, Amazon controlled the transportation of 72% of its packages in 2021, up from just 45% in 2019. But that wasn’t, and still isn’t, 100% – and that’s not due to lack of capacity.

In 2022, Amazon overexpanded their logistics network to the point where they had to delay openings of distribution centers. Amazon CFO Brian Olsavsky has said they have “excess capacity” they need to “grow into.”

Buy With Prime, and profiting off of that capacity, is how they’re growing.

“If you build it…”

Merchants will come (to Buy with Prime).

The benefits are clear. 59% of American households have at least one Prime membership, and seeing the Prime logo they associate with reliable, fast, and free delivery can be pivotal in purchase decisions. This, combined with the ease of a one-click checkout, led to a 25% conversion rate increase in Buy With Prime’s beta testing.

The sales benefits don’t end there. Historically, many FBA merchants have sold their products exclusively on Amazon. Many view creating a website, building brand awareness, and assembling a logistics network as daunting tasks, and FBA offers an opportunity to focus on nothing more than selling products. However, they miss out on opportunities from not selling direct-to-consumer on their own site.

Brand visibility is limited on Amazon (can you remember the brands of the last three things you bought through Amazon?). With their own site, merchants can present their products with a unique branded experience and build affinity that leads to repeat purchases.

Additionally, Amazon merchants aren’t given identifiable info on who they’re selling to. But they can incentivize customers to enter their email information on their own site, creating remarketing opportunities.

- A merchant’s site is a more logical option for advertising.

- Driving to a product page on Amazon shows potential customers recommended products from competitors.

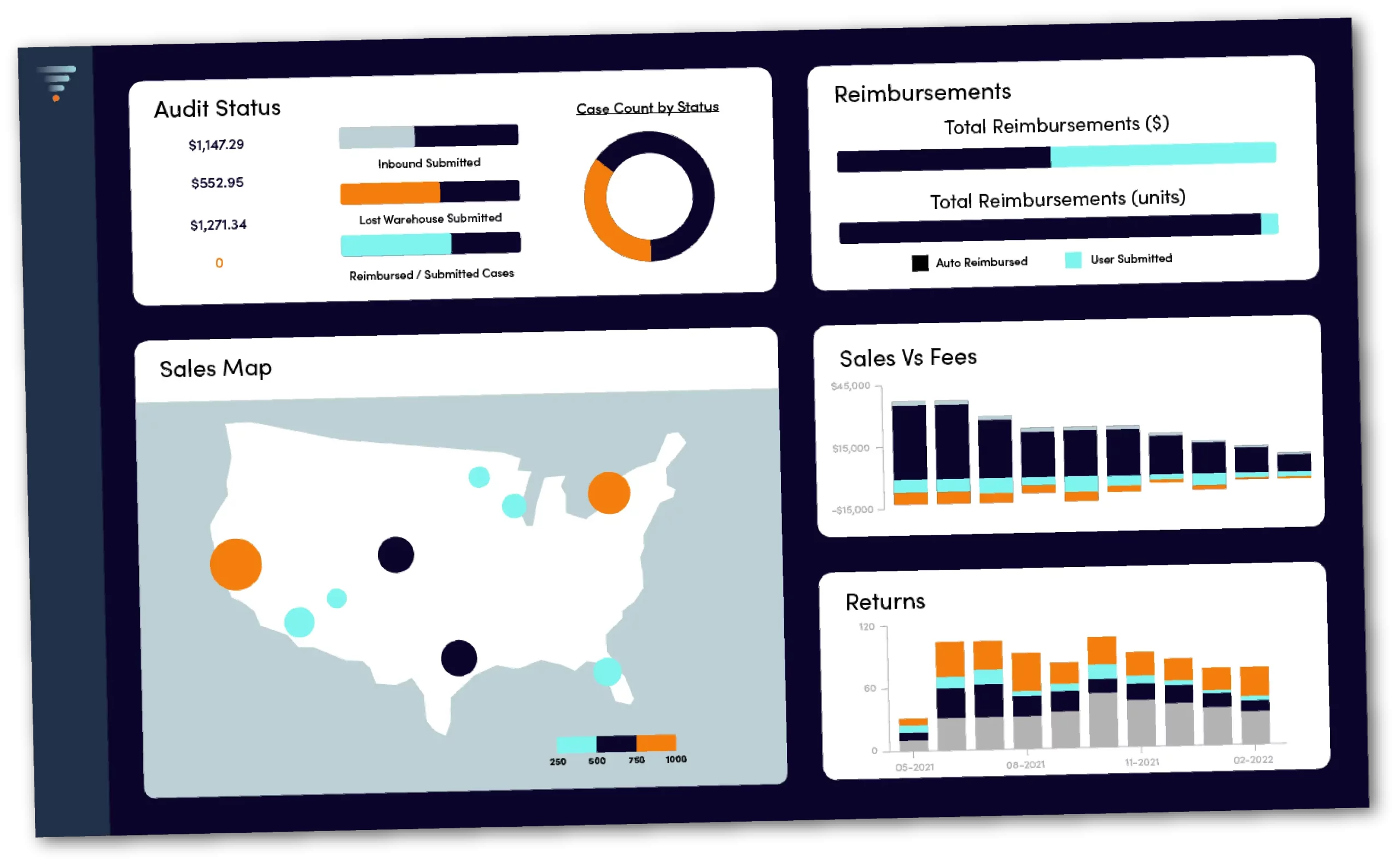

- And with intelligent data analytics, merchants can also look at their geographic sales performance, revolutionizing how and where they advertise their products.

Buy With Prime creates an opportunity for FBA sellers to quickly set up a site with a service like Shopify and gain these strategic advantages without sacrificing their access to Amazon’s logistics capabilities.

What Else Does Buy With Prime Change for the Shipping Market?

Buy With Prime expands the horizons for sellers. One of the biggest impacts of change is that now Amazon will do your sorting and distribution and “white labeling” services. This is huge.

It means you could have 100% of your inventory at Amazon warehouses, and link up to another big marketplace like Walmart and have your Shopify, Amazon, and Walmart sales all linked to the same inventory and fulfilled by Amazon. This wasn’t possible before because Amazon used branded packaging, and Walmart wasn’t down with that. An unbranded packaging option now lets shippers operate through other websites, like Walmart, while benefiting from Amazon services with no other needed agreements.

More importantly, it solves the biggest headaches for eCommerce sellers who don’t want separate fulfillment strategies and inventory management for every online store.

And that’s not all. Amazon knows what they’re doing. Their Buy With Prime integration with Shopify gives sellers an even bigger platform to ship through their own websites. Shopify’s main objective in this relationship with Amazon is trying to support its sellers with fulfillment efforts by partnering with Buy With Prime, which would bring more sellers to Shopify to create their own websites.

Overall, Amazon’s new service has the potential to revolutionize the online marketplace industry, simplify the process for sellers, and provide a unique advantage to Amazon, Walmart, and Shopify alike.

Get Back the Money You’re Owed from Amazon

How Can Current eCommerce Sellers Benefit From Buy With Prime?

Pandemic-related capacity issues opened the eyes of parcel shippers nationwide. Shipping with only one carrier is no longer an option, and we’ve seen regional carriers expanding their capabilities to become even more viable alternatives to FedEx and UPS. Amazon has now entered that mix.

Shippers looking to diversify their carrier mix can use Buy With Prime and pre-determine a set amount of volume they want to ship through Amazon (as they’ll have to pre-ship units to an Amazon facility). Should inventory at their own warehouse run out, they can easily divert sales and shipments to Buy With Prime.

Large shippers might worry about losing volume-based discounts with their carriers, but logistics intelligence and proper data analysis can find the right amount of volume to shift to Amazon (or elsewhere).

- This creates “swimlanes” for more resilient shipping

- Gives them a boost in customer experience with free two-day shipping

- And increases sales conversions, as the data suggests

Buy With Prime Is One of the Most Important Shipping Innovations in Decades

Buy With Prime marks a significant milestone in the shipping industry, providing countless opportunities for both Amazon sellers and merchants operating on their own platforms. Amazon has made significant strides in expanding its logistics capabilities to create a vast network, making Buy With Prime a compelling option for shipping needs.

The program’s new open-door policy for eCommerce businesses to use its Prime services on their own sites–regardless of FBA/FBM status–is driving more shippers to diversify their carrier mix with an Amazon partnership to ship/fulfill their products. And if you’re shipping (or planning to ship) with Amazon, you can’t afford to skip on the latest innovations in Amazon seller tech.

Amazon has signaled its intent to rival shipping giants like FedEx and UPS, making it clear that they’re a major player in the game. How long will it be until they’re the next national carrier?