At the risk of stating the obvious, 2020 has been a wild ride so far. The effect of the pandemic and resulting safety measures has been dramatic — especially on shipping and the supply chain.

How we operated before COVID-19

Before the crisis, supply chains were optimized for their immediate operating goals using just-in-time practices to minimize inventories, delivery times, and costs. Consumer demand for responsiveness in product variety and delivery speed forced competitive pressure to create highly optimized and lean supply chains. But being responsive requires accurate forecasts of product demand, and sudden changes in demand will strain the system’s ability to respond and be very disruptive.

The recent scarcity of toilet paper and hand sanitizer is the best example of this challenge. In other cases, the demand for products didn’t change so much as the distribution channel that was needed to serve the demand shifted. For instance, portions of the food supply chain shifted from restaurant delivery to grocery stores requiring different labeling, packaging, and quantities.

We can see scenarios like these among the shippers we work with as well. By taking a big-picture view of these patterns among our 5,000+ shippers, we can glimpse the evolving world of product distribution and speculate about what it means and where it is going. We dug into the data and found some notable trends.

What’s happening now

At a high level, considering the shipping volume as a whole, it is apparent that fewer parcel packages are traversing the carrier networks. The economic impact increased shortly after stay-at-home orders were broadly in effect and relative to the national emergency declaration.

However, in recent weeks, a bit of correction appears to be taking place, and volume is rebounding. As life goes on, the demand for some products has started to recover. But, in many cases, the usual distribution channels are not available because most retail stores have been closed since mid-March.

Even where retail stores remained open because they were deemed essential, consumer behavior might be starting to shift. Online shopping, the dominant consumer trend of the last decade, received a boost with the COVID-19 crisis by forcing the use of online vendors for products unavailable otherwise, by encouraging it for slow adopters, and by driving it for products not usually purchased online.

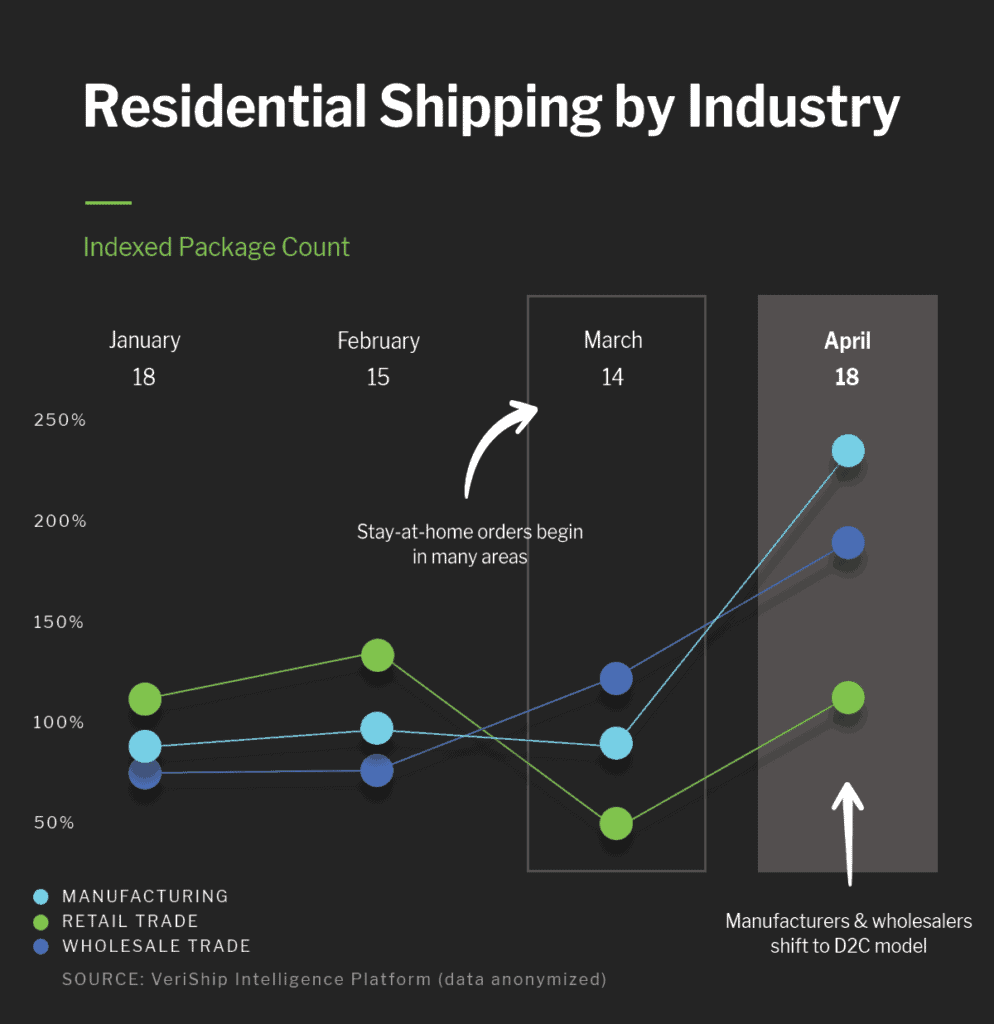

A look at sectors like Manufacturing, Wholesale, and Retail reveals evidence of both the negative effect upon shipping volume and of a shift toward a direct-to-consumer (D2C) distribution model. The graph below shows how manufacturers and wholesalers have stepped in to fill the void left by shuttered retail stores.

The agility to make this shift so fast is impressive and may prove to be the difference between success and failure, but it may also introduce some problems if these changes are here to stay. Shippers in all industries will quickly see their costs rise if their distribution networks and carrier contracts aren’t optimized for this D2C world.

What you can do as a shipper

If the disease resurges in the coming months as some predict, we might see more closures that increase residential deliveries again. The residential delivery surcharge can be difficult to minimize, but there are a few strategies you can try:

- Contact your carrier rep and re-optimize your residential delivery surcharge. UPS reported that nearly 70% of its March volume was business-to-consumer deliveries. If you’re one of the first in line asking for a reduction in your rate on this surcharge, you’ll have better luck. Knowing your own residential shipping volume will help. They want to keep you as a customer and will likely work with you if you have your data in hand to show the business you can drive for the carrier.

- While you talk with your rep, discuss optimizing a better ground residential rate. With service guarantees suspended, more shippers are turning to ground options. However, if your contract was built around the express services you used to provide customers, you might have very poor ground rates. Now is the time to ask for better ones. Again, knowing your own data gives you a stronger position to optimize from.

- Even with people at home more, porch pirates are still a problem. Encourage your customers to ship to carrier access points at retail locations they’re likely headed to anyway, like supermarkets and drugstores, or to carrier lockers for a contactless experience. It will help them get their packages safely and keep your costs down.

Don’t get scared — get prepared

This sudden shock to our economy has thrown us all for a loop. But you can weather this storm if you prepare properly, arming yourself with relevant data to truly understand what you’re shipping, where it’s going, how much it costs you — and why it costs what it does. With that information in hand, you’ll be able to adjust your own shipping operations and work with your carrier to strike a deal that benefits you both.

Residential delivery costs aren’t the only surcharges that can get out of control. Learn more in our new eBook, 5 Budget-Busting Surcharges & How to Lower Them.