As the 2026 General Rate Increase (GRI) approaches, businesses are preparing for changes that could significantly affect their shipping costs. Bulky, heavy, and long-distance shippers will likely feel the squeeze most, though every business will be affected to some degree. Understanding exactly how the GRI will impact your unique shipping costs is vital in an environment where parcel demand is lagging, carrier competition is heating up, and network cost-cutting is in full swing.

To give shippers an idea of what to expect this year, we talked with experts at Sifted: Mark Kolde, Head of Client Success, and Jeremy Lee, Head of Sales.

Here’s what they had to say about the 2026 GRI and how shippers can get ahead of it.

Q: Can you break down what the General Rate Increase (GRI) is and why FedEx and UPS implement it every year?

A: General Rate Increases are implemented annually to adjust the carriers’ base rates, or published rates, to account for inflationary and variable operating costs necessary to maintain service to their customers.

Each year, the carriers increase their published base rates to address specific market conditions. Each service level may have a separate and unique increase, and the percentage will vary by weight and zone within a designated service.

Q: What trends from 2025 are most likely to carry into 2026? Are we in for another repeat of the 5.9% increase?

A: With the national carriers’ volumes down in a continued shippers market, margin protection is the name of the game. Carriers are continuing to raise existing fees and rates, while also introducing new charges and updating the conditions that trigger them.

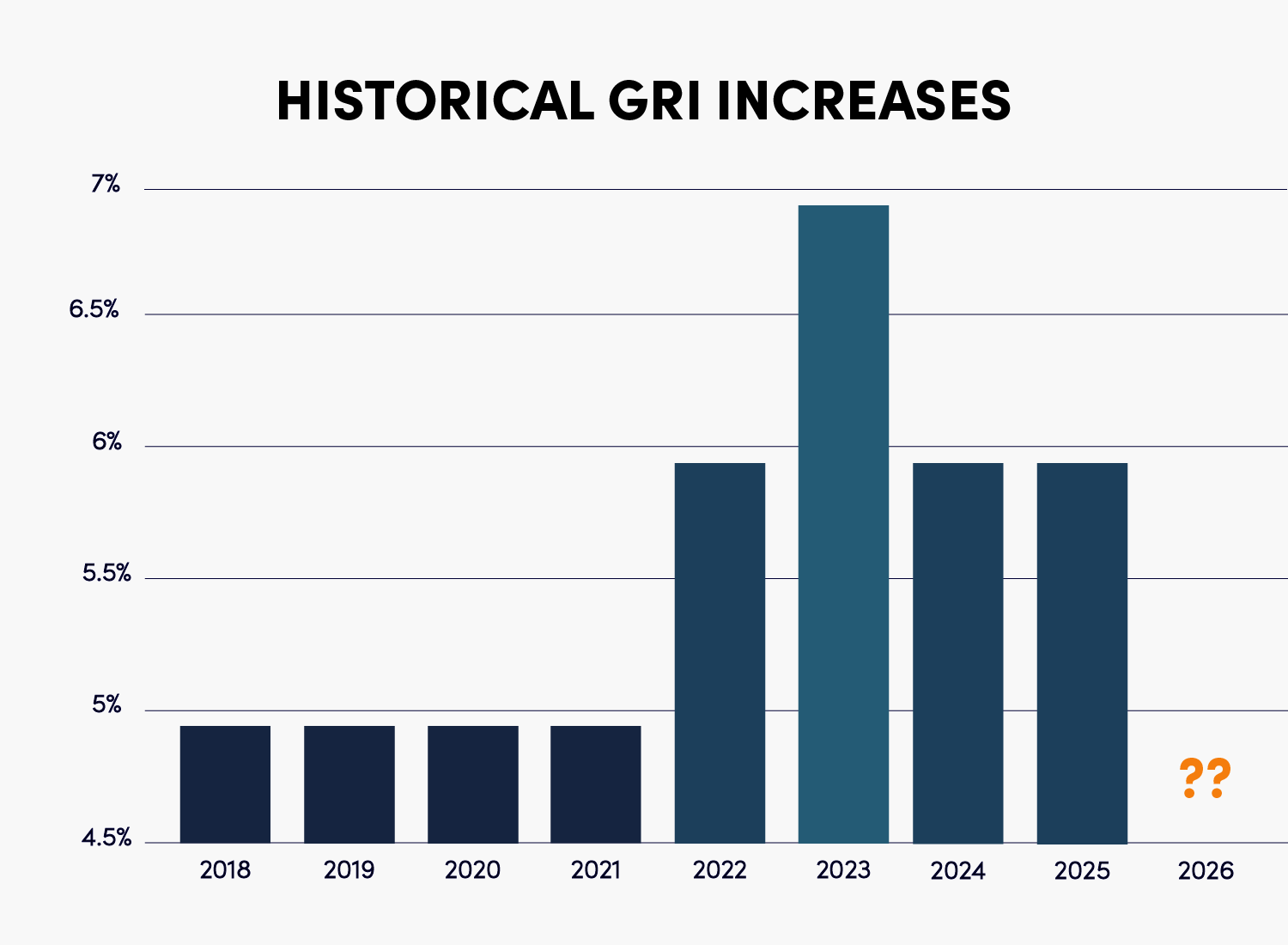

UPS and FedEx’s GRIs had been fairly consistent at a published 4.9% until COVID hit the market in 2020, and we saw higher increases due to a surge in demand. Shippers faced three options: adjust their behavior to reduce fees, try to negotiate concessions, or accept the increases, either absorbing the cost themselves or passing it on to their customers.

We expect this to continue in 2026, with the GRIs being similar or slightly higher than those of 2025.

Q: How do you expect ongoing economic pressures like labor costs, declining parcel demand, and shifting carrier strategies to shape the 2026 GRI?

A: Margin protection and improvement is critical for the carriers right now, so we expect similar trends in 2026 as we saw last year. If the carriers can maintain or improve their margins with less volume, that would be a positive for them, but overhead would need to be addressed as well. This is why you see UPS and FedEx announcements around hub and sortation closures, driver buyouts, and other overhead containment strategies.

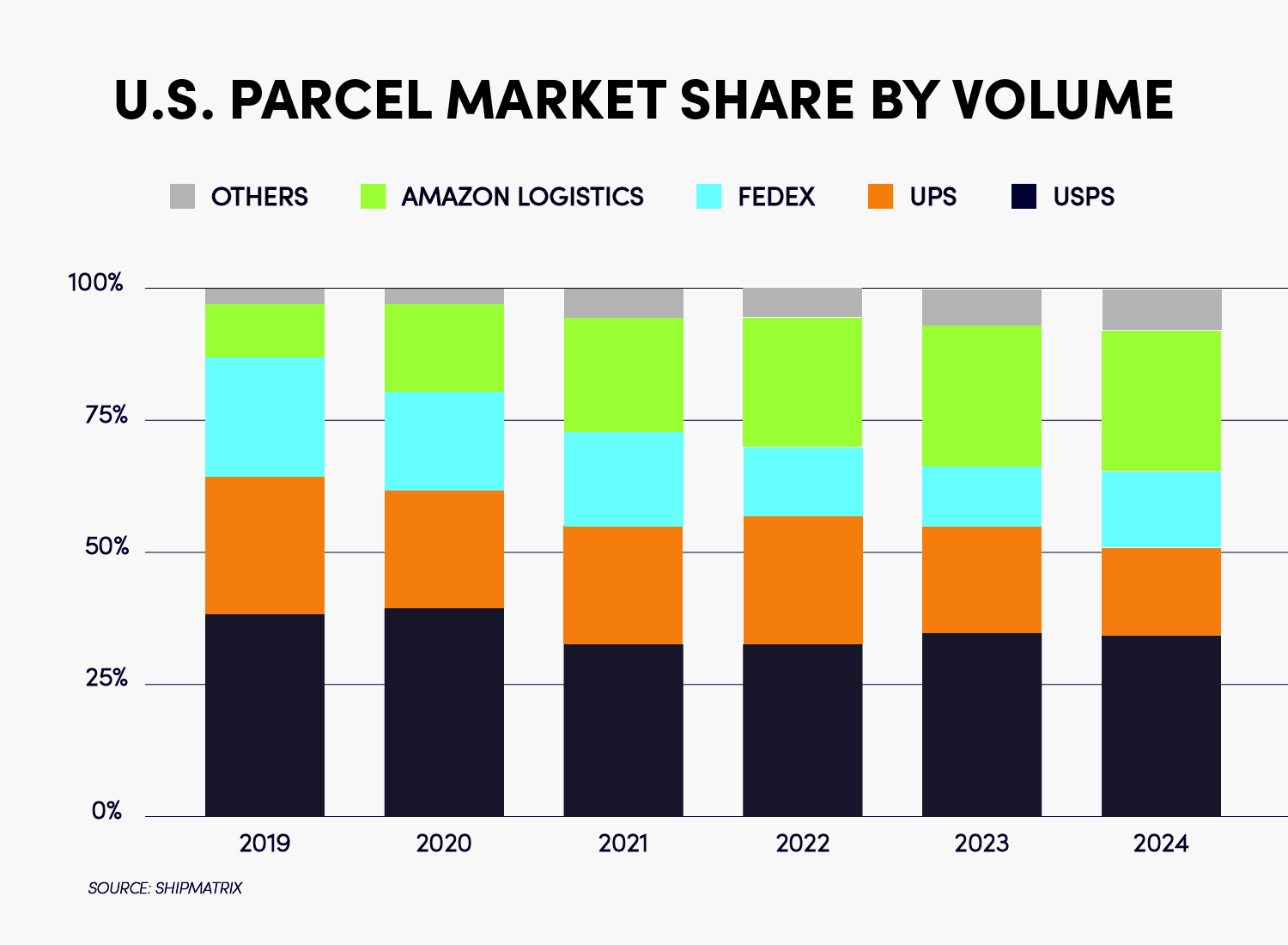

Also, carrier diversification has become mainstream in small parcel shipping. Historically, diversification was more of a “lever” shippers could pull if and when capacity constraints kicked in (e.g., Q4 peak season). Since COVID, diversification has become less of a “shiny new toy” and more of a defined and necessary part of a shipper’s parcel supply chain strategy.

The market continues to support this with a four-carrier national market now in place (UPS, FedEx, USPS, and Amazon). Amazon carries more volume than UPS or FedEx, and they expect to handle more volume than the USPS by 2028. Plus, regional players with increased coverage and reach exacerbate the already downward trend of market share for UPS and FedEx.

This all drives a focus on doing more with less. Expect to see more margin protection in the coming years.

Q: Do certain industries feel the GRI more than others? If so, which ones are impacted most, and what makes them more vulnerable to these annual rate increases?

A: GRIs are designed to either incentivize or curb costs for certain behaviors. For instance, customers that ship to further zones are often penalized with higher GRI increases, as are heavier-weight shippers. These types of shipments are harder and more costly for carriers.

Both UPS & FedEx have also been very purposeful around increases for shippers with large cube parcels. Think furniture, hefty equipment and devices, automotive, mattresses, etc.

Last year, the increases on cube-based fees alone with UPS & FedEx averaged over 26%. Since then, the carriers have announced new logic that applies to cube calculations, as well as rounding rules for dimensional weights. All of which are designed to charge shippers more per cubic foot of volume tendered.

Q: When the GRI is announced, a lot of shippers focus on the headline percentage, but what are they missing by stopping there?

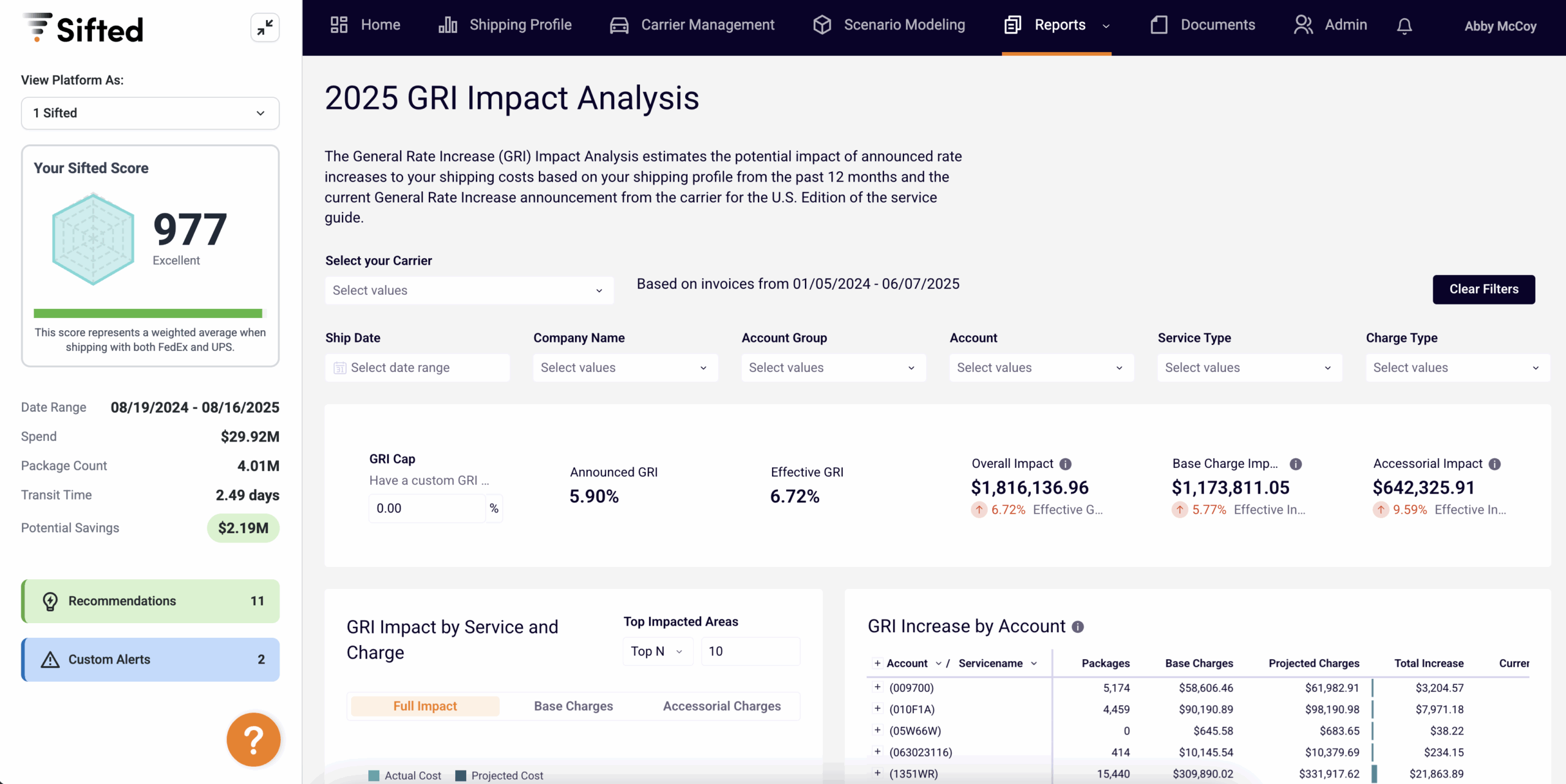

A: Relying on the announced “Net Average” can leave shippers surprised by much higher cost increases. Actual impacts vary widely by zone, service level, and package profile, with hidden surcharges and structural changes often driving double-digit jumps. Without modeling the GRI against your own shipment data, you can’t see where you’re most exposed or take action to mitigate the damage.

Q: With all the focus on rising costs, where are the biggest opportunities for shippers to take back control and actually lower their spend heading into 2026?

- Optimize packaging: Finding opportunities to right‑size your packaging has never been more important. The goal is to reduce any potential impact from dimensional weight and minimize surcharges.

- Diversify carriers: A multi-carrier strategy allows you to optimize your operation for reliability, quality, resilience, speed, and cost.

- Mix optimization: It is important to understand the strengths and weaknesses of your network. If you know where you are winning and losing with each of your carriers, you can leverage your carriers’ strengths to align delivery speed with customer expectations and cost efficiency with quality.

- Test and model adjustments: Research, plan, simulate, and repeat. We built SiftedAI with this process in mind, empowering shippers to easily see the impact of mixing carriers, building networks, shifting services, zones, and operational strategies before committing to them. This way, you always have the right play, no matter what disruptions arise.

When it comes to the GRI, the difference between reacting and planning can mean significant cost savings for shippers.

Shippers who take a proactive approach, by modeling the impact of surcharge changes and optimizing their carrier mix, will be in a much stronger position when the 2026 GRI takes effect.

Logistics Intelligence software, like SiftedAI, gives you a true single source of truth to understand the past, present, and future of your parcel operations. Being able to automatically forecast the true impact of the GRI is especially important so that you can take action before it erodes your margins.

By modeling the increase against your actual historical shipping data, you can pinpoint where costs will spike and uncover the impacts of fees and surcharges that would otherwise be hidden. With this visibility, you can proactively adjust service mix, rebalance carriers, optimize fulfillment locations, and enter carrier conversations with targeted, data-backed talking points. Instead of reacting to higher invoices, shippers can strategically plan to blunt the GRI’s impact, protect profitability, and maintain competitive delivery performance.

Get ahead of the GRI.