A version of this article appears in the November/December issue of PARCEL and at parcelindustry.com.

“Shipping profile? Check. We received it from our carrier representative at our last account review.”

No, really, do you know what your shipping profile actually looked like last year? Has it remained consistent in 2018? Is your parcel shipping profile expected to be similar in 2019? What about 2020? Don’t scoff; after all, the year 2020 is just over 13 months away. That means that elements of your shipping profile may change twice by 2020, thanks to the carriers’ annual general rate increase (GRI).

What about your carrier agreement? Was it optimized with your shipping profile in mind? I will accurately answer that for you, and I don’t even need your response. That is because the carriers understand your shipping profile, and they absolutely use their data-driven analytics machine to ensure your “unique” discounts and terms maintain their historically strong profit margins. Do you have a data-driven analytics machine? I imagine I can answer that question for you, too. Even if you wanted to utilize a data-driven approach to understanding and resolving your parcel pain, do you really want to invest the time and resources to building the necessary structure to do so?

Understanding your shipping profile is a key element in so many of your organization’s strategical and tactical planning. From financial forecasting to raw material procurement to customer experience, your shipping profile more than likely impacts more facets of your operation than you even realize.

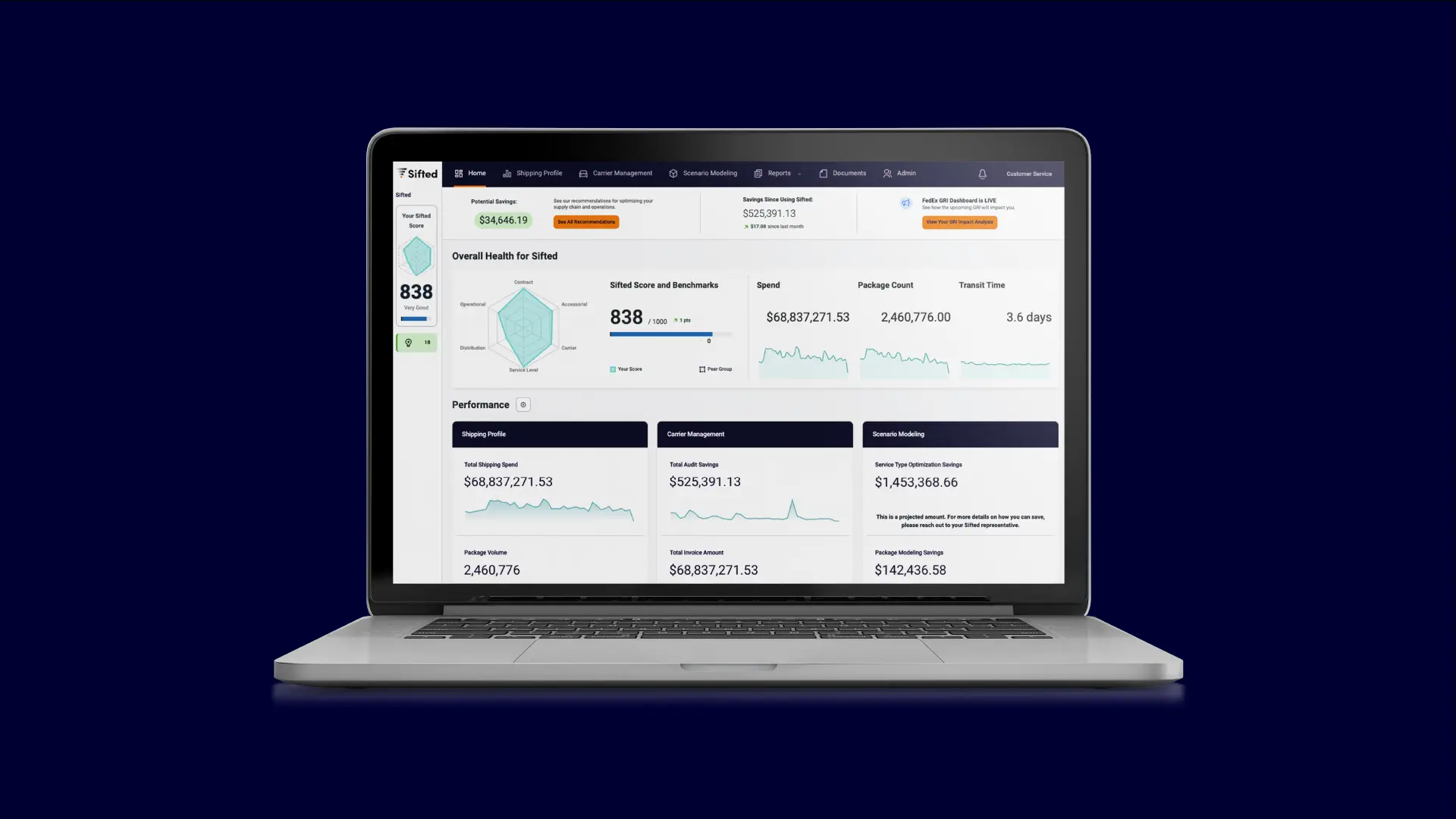

What’s Included in Your Profile?

So, what is typically meant by the term, “shipping profile”? Simply put, your shipping profile classifies the characteristics of your shipments and identifies trends within those shipments. What is not so simple is identifying and translating the meaningful data points within the carriers’ invoices, pricing agreements, and service guides to construct that shipping profile. Service types, package weights, package dimensions, pick-up location(s), delivery location(s), as well as other specific shipment characteristics the carriers target by leveraging steep surcharges are all common elements of a shipping profile. For shippers, this significantly complicates the challenge of identifying and organizing (not to mention making sense of) how the elements of the shipping profile interact with and impact one another.

Furthermore, a shipping profile delivers descriptive data, but most shippers are interested in reducing costs and implementing operational efficiencies. In order to do that, shippers need to utilize data science methodologies to conduct predictive and prescriptive parcel analytics. Since most shippers focus their time and resources on areas of their business out of necessity, they are left to trust the carrier to identify and resolve shipping behaviors that are specifically causing the shipper parcel pain.

As I alluded to earlier, understanding the shipping profile is vital to an organization’s ability to operate efficiently and effectively. I have been shocked over the years to learn how many shippers attempt to optimize their own parcel shipping rates and terms without a complete understanding of their shipping profile. (Insert your perfect analogy here, such as baking without a recipe, or without even the ingredients, for that matter.)

How Do the Carriers Utilize Your Info?

Both UPS and FedEx have a rather simplistic method in constructing your custom discounts and terms. No, it’s not primarily based on the size of shipper you are. While your shipment volume trend may be part of your carrier representative’s positioning when approached about reducing costs, it actually plays far less of a role than you might think. That is why as a shipper’s package volume increases, their pricing does not incrementally improve as well. That said, you may have earned tier discounts in your carrier agreement that provide additional discount incentives based on spend, but take a look at the downside vs. the upside. Growth into the next volume tier and beyond is typically rewarded with a one to two percent discount increase, while dropping just one volume tier can result in five percent to 10% of your discount being stripped away. This is common practice with each carrier.

Carriers view your shipping data through more of a microscopic lens than shippers traditionally do. The carriers slice and dice the data to identify common shipment characteristics to define a shipper’s standard shipment. The carriers then model how that standard shipment will likely move through their network, and identify what the predictive network touchpoints are, which are often viewed as risks by the carriers. Once the carrier calculates the cost and risk associated with handling your shipments, the carrier will consider other factors like their own network capacity, the competitive environment, potential ancillary service attachment, and the shipper’s opportunity for growth.

The complexity involved with identifying and effectively utilizing your shipping profile to drive carrier optimization, contract optimization, and operational optimization can be daunting, but shippers can no longer kick this issue down the road. The urgency to resolve this gap will only continue to grow exponentially as more and more shippers aim to absorb the rising cost of shipping.