As we welcome in the new year, the parcel shipping industry is undergoing waves of changes – many of which started in 2024 and will accelerate in 2025.

These changes are driven by evolving consumer behaviors, regulatory developments, and technological innovations.

For shippers, staying ahead of these trends is critical to managing costs and maintaining customer satisfaction.

Here are the key trends to watch and how you can capitalize on them.

1. Alternative Carriers Will Continue Expanding Their Reach

2024 was a year of major growth for alternative carriers’ networks. Here are some of last year’s headlines:

- OnTrac launched a Midwest expansion to reach 17 million new consumers and began delivering on weekends

- Better Trucks began delivering to millions of new households in New England and the Southwest

- Rapidly-growing Veho added Detroit, MI and Columbus, OH to its network

These carriers aren’t just betting on potential market growth – they’re meeting existing demand. The average number of carriers parcel shippers employ has seen significant growth since 2020. And while that growth slowed in late 2023, it held steady in 2024.

National Players

More than ever, shippers value the flexibility and resiliency of a diverse mix of carriers – and carriers outside of FedEx and UPS can offer competitive services nationwide.

The United States Postal Service is full-steam ahead in their transformation plan, “Delivering for America.” The agency is transforming their network to improve performance and financial sustainability – which ultimately means becoming a more competitive player in the commercial parcel market.

As a result, they consolidated three separate parcel services into Ground Advantage, which successfully drew the USPS an increase in volume in its first year.

Amazon Shipping, which made shockwaves when it was launched in late 2023, had a quiet 2024, with the only major news coming when Amazon introduced a complimentary third-party air service.

Long-Term Partners

This shift in the carrier landscape is causing many shippers to rethink their diversification strategy.

In the past, many have viewed them as a short-term option to find extra capacity. Others have committed to long-term agreements, but with low volume commitments.

As alternative carriers’ networks become more capable, a growing number of clients are viewing them as a viable option for a significant portion of their volume.

In 2025 and beyond, alternative carriers won’t just get more volume – they’ll get volume that lasts.

2025 Tip: Explore Alternative Carriers

Evaluate your shipping profile and find segments of your shipping volume where alternative carriers can provide cost savings or improved service. Diversifying your carrier mix can improve your resiliency and help you lower overall costs.

2. USPS Parcel Select Changes Will Ripple Across the Industry

The USPS’ aforementioned “Delivering for America” plan has already made a massive impact on the industry through strategic changes to their Parcel Select service.

Carriers use Parcel Select to give packages to the USPS for final delivery. In most cases, they’d carry the package for most of its journey before injecting it into the USPS’ network at the delivery-unit level (Post Offices) for last-mile delivery – the most inefficient portion of the delivery.

In the summer of 2024, the agency implemented a 25% average rate increase for Parcel Select. The increases were designed to incentivize partners giving the Postal Service volume earlier in the process.

In 2025, they’re implementing a 10.3% price increase for delivery unit entry. Prices for Parcel Select packages given to the USPS at the hub level aren’t increasing.

| Service Type & Price Increase | |

|---|---|

| Ground Advantage (commercial) | 3.2% |

| Priority Mail | 3.2% |

| Priority Mail Express | 3.2% |

| Parcel Select (average) | 9.2% |

| Parcel Select (delivery unit entry) | 10.3% |

| Parcel Select (hub entry) | 0% |

| Parcel Select (sectional center facility entry) | 7.1% |

| Parcel Select (network distribution center entry) | 9.7% |

Additionally, the USPS announced the end of negotiated discount agreements for partners for delivery-unit entry parcel select packages – meaning other major carriers like FedEx or UPS can only get discounted rates if they give a package to the USPS further upstream in their network.

Industry-Wide Impacts

The ripple effects of the changes to Parcel Select are only beginning to play out.

Pitney Bowes has already shuttered their Global Ecommerce unit, which relied heavily on Parcel Select. While not the only reason for the closure, the higher costs played a role in Pitney Bowes’ decision.

In 2025, Parcel Select price increases are creating a challenge for other carrier services that used the USPS, such as FedEx’s Ground Economy and UPS’ SurePost. Both have long functioned as some of the carriers’ most cost-friendly services, but higher rates are putting a strain on this. In early January, news broke that UPS would no longer partner with the USPS for SurePost deliveries.

Other “postal consolidators” like DHL eCommerce and OSM Worldwide, which rely on the USPS even more, will have to adjust to the higher operating costs with Parcel Select.

2025 Tip: Navigate Parcel Select Changes

Whether you work directly with them or not, assess your dependency on the USPS for deliveries and properly account for rate increases. Keep an open line of communication with your carrier reps to stay informed on how their adjustments may affect you. Steady, data-informed communication can foster winning scenarios for you and your carriers.

3. Consumers Will Push Back on High Shipping Costs

For years, the “Amazon Effect” made two-day delivery an expectation, as retailers used fast (and often free) delivery to stand out from competitors. But years of record-high General Rate Increases have forced retailers to take a hard look at the shipping fees they charge customers.

Meanwhile, years of high inflation have left consumers feeling fatigued from price increases – and those shipping fees are no exception.

A few statistics showing consumer attitudes towards high shipping costs:

- High shipping costs (and other fees) are the cause of 48% of abandoned carts

- 62% of online shoppers won’t purchase from a retailer that doesn’t offer free shipping

- “Shipping Cost” is the most important factor when purchasing online, ahead of reviews and cost of the item itself

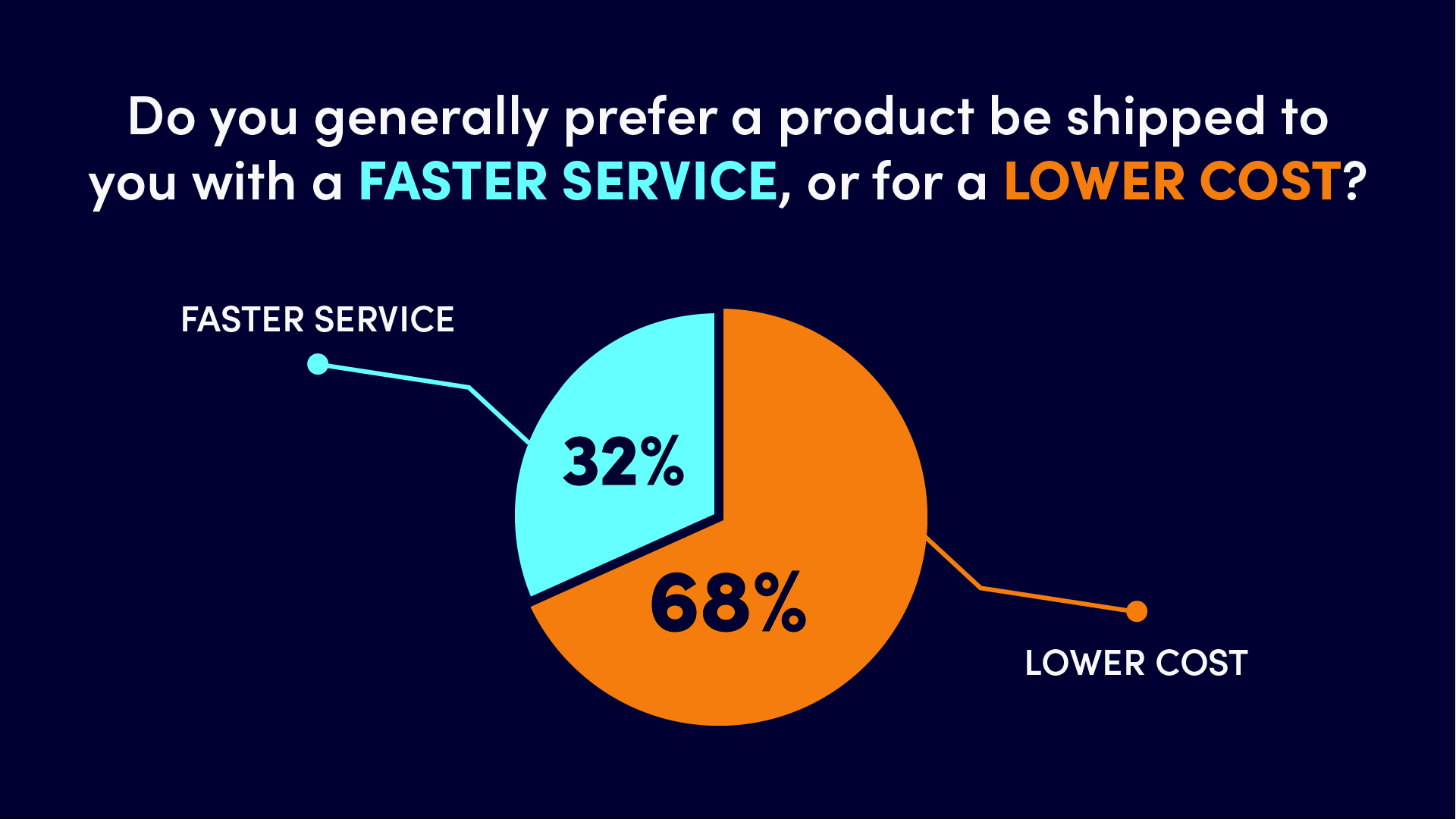

As a result, more consumers are opting for cheaper, slower delivery options. A 2024 Sifted survey found that 68% of online shoppers prefer a lower shipping cost over a faster shipping speed.

Carrier reports have reflected a higher demand for cheaper, “deferred” services.

- In a July 2024 earnings call, UPS noted a trend in clients trading down to cheaper services.

- FedEx executives reported the same trend in September.

- The U.S. Postal Service saw a 40.7% decline in Priority Mail volume YoY for Q3 of FY2024.

It’s likely that shippers opting for cheaper services and consumers choosing those themselves are both driving this trend – and we expect this to ramp up further in 2025.

2025 Tip: Cater to Consumer Shipping Price Sensitivity

Offer consumers several price points for shipping. Most prefer a few options, as 74% of our survey respondents prefer to have multiple shipping options at checkout.

It’s important to strike a balance between variety and simplicity.

“You don’t want to go overboard,” according to Danna Nieto, channel account manager at BigCommerce. “You don’t want 20 options for shipping. Then (your customers) will have analysis paralysis.”

For those “options,” consider alternative delivery methods.

The rise of Buy-Online-Pickup-In-Store (BOPIS) is an adjacent trend, and one any online retailer should consider. By shipping to a brick-and-mortar retail location, you can avoid costly Residential Surcharges, and your customers have the peace of mind that their package is safe from porch pirates.

Offering BOPIS might be viewed by some as a luxury, but over time, it may become an expectation.

BOPIS sales reached $345 billion in 2022, and this number is expected to grow to $666 billion by 2028.

If your company lacks an expansive network of your own brick-and-mortar locations, explore other partnership options to offer BOPIS at different access points.

4. New Delivery Methods Will Gain Traction

Like BOPIS, other innovative delivery methods like gig drivers and drones are making inroads into the market. These new approaches can promise ultra-fast delivery for shipments within a local area.

Gig driver industry setting sights on parcel delivery

Gig drivers, often employed through app-based platforms, can quickly scale to meet demand surges, offering shippers flexibility during peak periods. The gig model has already revolutionized the restaurant delivery industry, and parcel delivery could be next.

Major carriers see the value, signaled by UPS’ 2021 acquisition of Roadie, a leading crowdsourced delivery provider. According to Roadie, their platform “enables local same-day delivery of just about anything, anywhere in the U.S.”

Other rising crowdsourced parcel delivery providers include Dropoff (U.S.), Sherpa (Australia), and Loggi (Brazil).

Drone delivery taking off

Drones present an exciting frontier for fast delivery, especially for small packages in suburban areas.

Major retailers are betting big on drones:

- Amazon plans for drones to deliver 500 million packages annually by 2030

- Walmart can deliver by drone to 4 million U.S. households

- Alphabet, parent company of Google, has invested heavily into their drone delivery company Wing

Drones are already delivering parcels in a number of markets across the U.S.

While regulatory hurdles and infrastructure requirements have slowed widespread adoption, 2024 saw significant progress. A major development was DroneUp receiving a landmark exemption from the FAA, which permitted flight beyond a visual line of sight (BVLOS). A few months later, Amazon received the same exemption, allowing them to scale their own drone deliveries.

BVLOS flights are still largely prohibited by the FAA, but as more companies demonstrate their capability for safe operations, it’s likely that more will be granted permission for these flights.

2025 Tip: New Delivery Methods

Stay informed about emerging delivery technologies and pilot programs in your area. Partnering with gig economy platforms or drone delivery providers can give you an edge in meeting consumer expectations for fast and efficient service. Conduct small-scale trials to evaluate the feasibility and cost-effectiveness of these methods for your business.

Planning Your Path in 2025

The U.S. parcel shipping industry is entering a transformative phase in 2025. By understanding these trends and proactively adjusting your strategies, you can position your business for success. Whether it’s diversifying your carrier network, adapting to changing consumer behaviors, or embracing new delivery technologies, staying agile is key.

Navigating these complexities and maintaining optimization in real-time can be challenging.

That’s where Sifted can help.

Our newsletters keep you up-to-date with important industry news, reports, trends, and shipping tips. Subscribe to our weekly LinkedIn Newsletter, The Parcel Playbook, or get a monthly update send directly to your email with Unboxed.

Additionally, SiftedAI empowers shippers with always-on monitoring and proactive recommendations, helping you uncover opportunities for cost savings, improve operational efficiency, and stay ahead in an ever-changing market.

Ready to make 2025 your most efficient shipping year yet? Request a demo of SiftedAI today.