Just when you think you have parcel shipping figured out, it changes on you.

Maybe rates changed more than you expected them to, wrecking your budget. Maybe a new surcharge was added and you’ve been seeing it pop up everywhere on your invoices.

And maybe your carrier is making mistakes and you haven’t noticed — meaning you’re losing out on refunds you should be getting.

You’re a busy person, so you might have let shipping audits slide. But it could be costing you big money, so it’s wise to dive in.

4 things to know about parcel audits

1) Why should you audit your shipping?

Carriers and their employees make mistakes (as most humans do). There are a lot of moving parts to shipping — and, in turn, a lot of room for error, like an overnight package that didn’t get there overnight or an address correction that shouldn’t have been applied.

As part of your service agreement, your carrier is accountable for these errors and providing you with a certain level of service. If they don’t meet these agreed-upon requirements, you’re due a refund for the failed part of the services. (And did you know you give up your right to the refund if you pay your bill before you find it? Don’t make that mistake!)

But it’s time-consuming to monitor all your shipments and invoices, so a lot of shippers leave this money on the table without realizing it. There are countless data points to monitor in your carrier reports, and tracking each package is challenging, especially if you don’t know what to look for.

2) How often should you audit?

You should audit every single invoice you receive from your carrier. Not only should you examine it right after you receive it, but also continuously until all the allotted time frames have passed for all auditable points. (Different audit points are allowed different lengths of time by the carriers to request credit.)

3) What are some auditable points you should look at?

Surcharges have a major impact beyond the initial shipping costs, and most shippers struggle to keep them under control. There are many fees that can be tacked on after a package leaves your facility. Some of them are preventable and some aren’t, but make sure they’re being applied accurately every time.

A few of the surcharges you should look out for are:

- Additional Handling: You can be billed for this surcharge based on weight, dimension or packaging type.

- Residential Delivery: When you ship to your customers’ homes, you’ll incur this charge.

- Delivery Area: There are nearly 25,000 ZIP codes in rural areas that will trigger this extra fee.

4) What will parcel audits do for your business?

Refunds! Not holding your carrier accountable for their mistakes can cost you thousands each year. But you won’t know about them unless you audit your invoices. It’s not your fault — the carriers make it difficult to monitor and analyze all your shipments. You’re also likely to find some costs you can control by making improvements to your shipping processes internally.

Another benefit: Often when your carrier sees that you’re monitoring your service and invoices closely, they step up their game. That’s a win for you and your customers.

How to stay on top of parcel audits

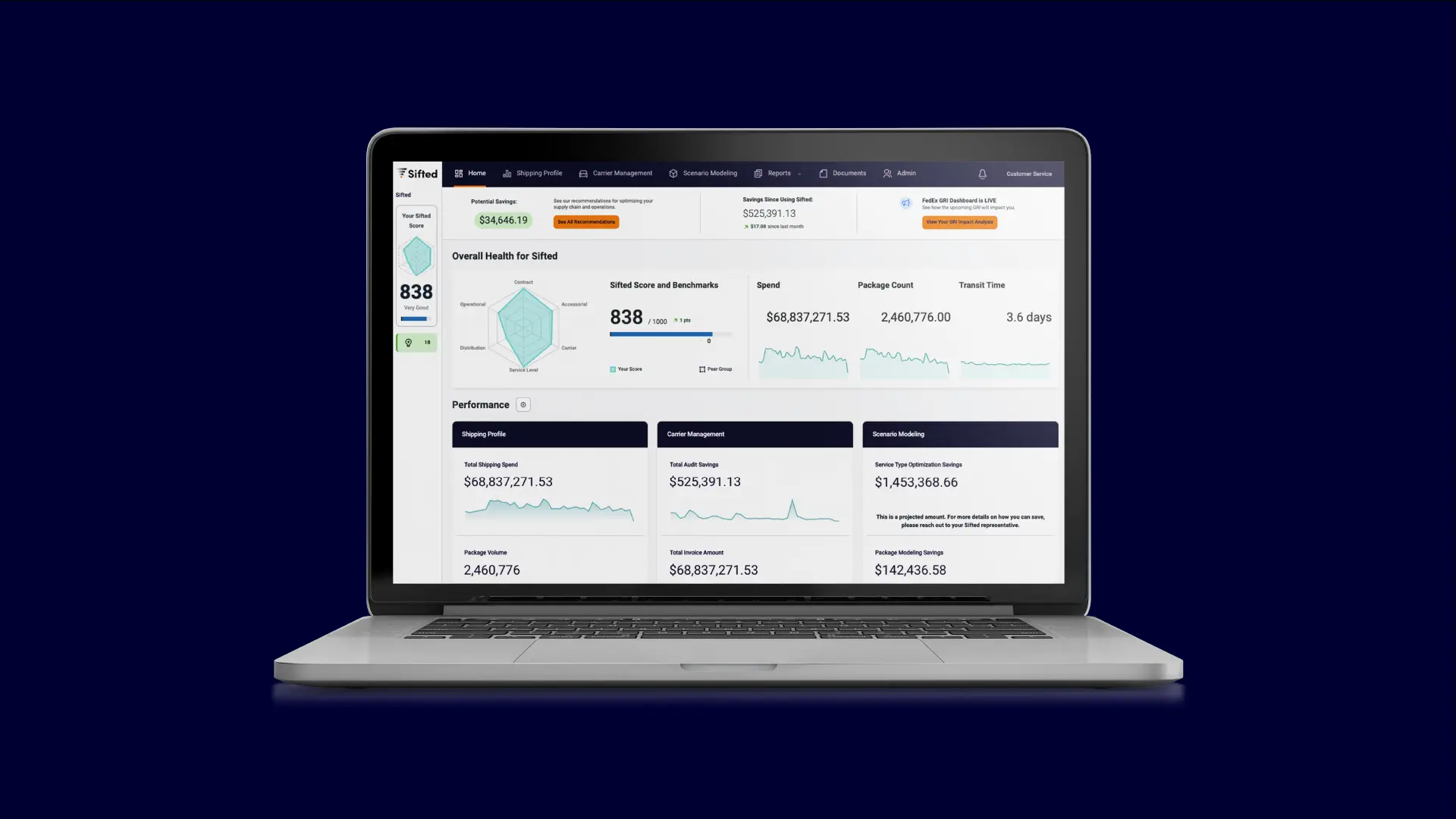

If you’re struggling to keep costs down or aren’t sure how to hold your carrier accountable with shipping audits, investigate tools to help. Make sure you look for one that offers:

- Monitoring of the complete range of auditable points in an invoice on a continual basis.

- Reporting of your parcel spend both at a high level and in a detailed view so you can stay informed and dig deep when needed.

- Alerts to help you stay on top of charges as they occur.

The more time I spend in the parcel shipping world, the more I realize how complicated and overwhelming it can be for shippers like you who have many, many other things to think about in their business. But holding carriers to their word will have a big impact on both your shipping practices and your shipping budget. Protect your bottom line by staying on top of parcel audits.

Want to see what one shipper did about it? Check out our eSigns case study.