In an era full of fast-paced change and challenges in parcel shipping, Amazon is finally throwing their hat into the ring of carriers. After years of speculation that they’d one day compete with FedEx and UPS, the eCommerce and tech giant is launching Amazon Shipping, a delivery service that bears a much closer resemblance to the national carriers than anything Amazon’s offered before. For now, Amazon shipping is only available to companies that sell on Amazon. However, the service will deliver packages from sales on a seller’s own website – not just those on Amazon.

Most believe these early restrictions are temporary, and that Amazon Shipping will be expanded to non-Amazon sellers, both in the eCommerce realm and beyond.

A Closer Look

For years, parcel experts have cried wolf that new shipping services from Amazon (Amazon Multi-Channel Fulfillment, Amazon Logistics, FBA, etc.) were their next big step towards challenging the carriers. At this point, some in the industry may be fatigued from it.

While Amazon Shipping may look like other offerings at a glance, this service has one key distinction – pickup. Past Amazon logistics services have required pre-shipping products to an Amazon storage facility, and Amazon would handle pick-and-pack while charging a litany of storage fees.

Now, for the first time, Amazon will offer pickup services. Amazon Shipping customers can schedule pickups from their own warehouse seven days a week, allowing them to integrate Amazon’s exceptional delivery services into their own logistics network. Currently, pickups are only available in 15 metro markets, a major short-term limitation.

Amazon Shipping Director Michael Cox shared they have plans to expand pickup services areas, saying “anywhere Amazon has a facility, we want to be there, so it’s just a matter of when.”

A quick overview of the service:

- Delivers packages weighing up to 50 lbs

- Pickup from sellers’ warehouses 7 days a week

- Delivers packages in 2-5 days (including weekends)

- No “express” deliveries offered

- Offers 24/7 warehouse-to-door tracking

- Delivers to the contiguous U.S., working with the USPS to “fully cover all delivery destinations”

Why Amazon Shipping Is an Attractive Option for eCommerce Shippers

Why would an established FedEx or UPS customer consider shifting volume to Amazon Shipping?

There are plenty of reasons. Let’s break them down.

1. Capitalizing on the Carrier Diversification Trend

COVID helped kickstart a trend of parcel carrier diversification. Shippers are adding multiple carriers into their mix, seeking risk reduction, improved transit times, or cost savings. This trend won’t reverse. The timing is right for a new player with a national reach.

And once they have that attention, expect Amazon to capitalize.

2. Competitive Rates

Amazon Shipping base rates appear to be very competitive. Ripley MacDonald, VP of Amazon Shipping, has shared that most customers pay 30% less than base rates with FedEx or UPS.

In addition to pricing, the pricing structure itself is claimed to be much simpler than that of FedEx or UPS. Even if prices are comparable, many shippers might be willing to switch to Amazon Shipping simply for the improved clarity in why they’re being charged what they are.

Notably, there’s no residential delivery surcharge. This is a home run for eCommerce businesses. Residential delivery surcharges are typically in the top three fees that we see among eCommerce shippers.

It makes sense that Amazon would make this a key selling point. Residential final-mile delivery is by far the most inefficient segment of the supply chain. Amazon, however, has specialized in residential delivery, and does it with remarkable efficiency. After all, the expectation of two-day delivery has long been called the “Amazon effect.”

Similarly, Amazon won’t charge extra fees for weekend deliveries. For eCommerce companies looking to satisfy their customers’ desire for the fastest delivery possible, this could be a significant source of savings.

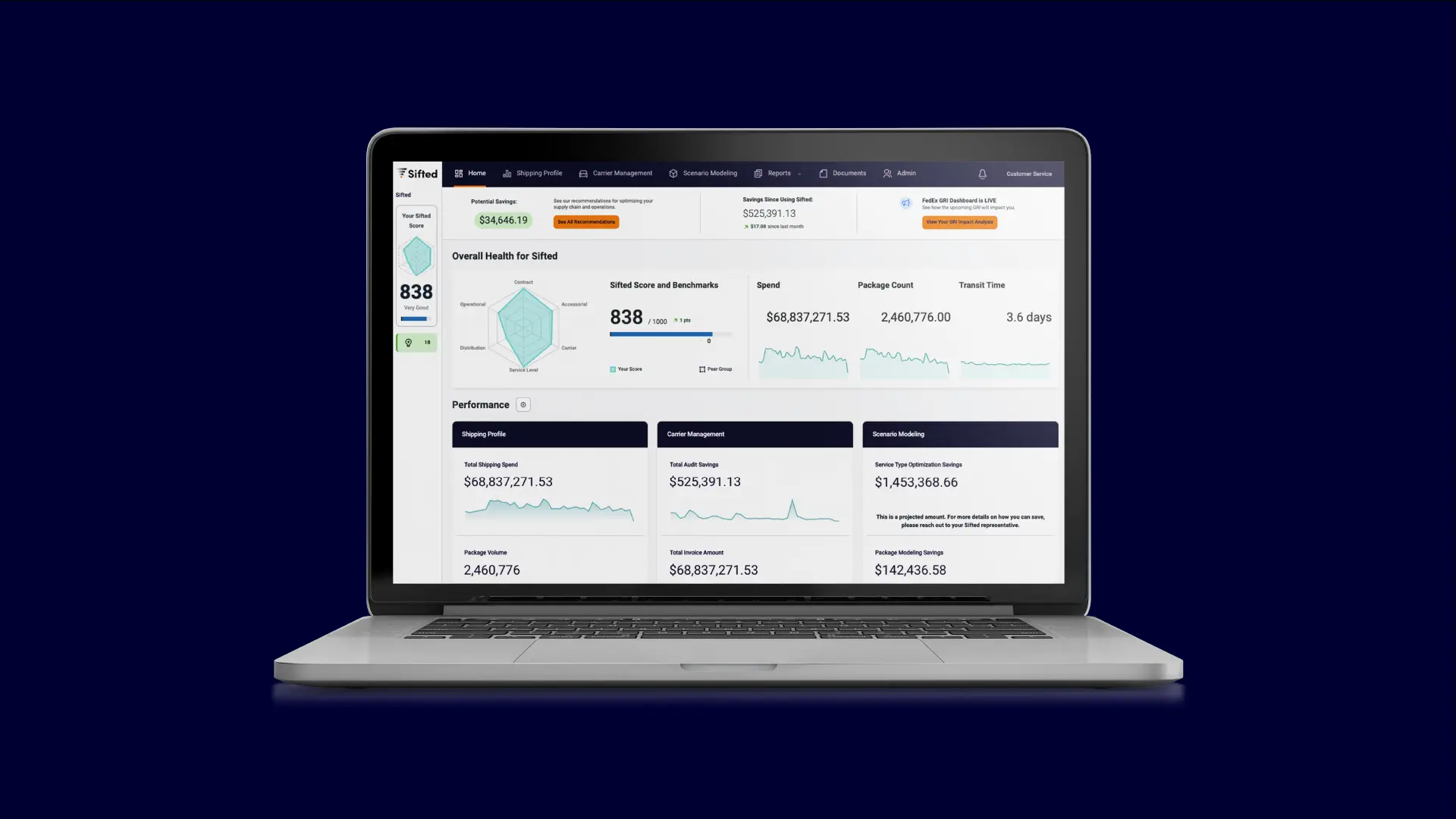

While Amazon Shipping promises a simplified fee structure, FBA sellers know that other Amazon services impose a number of fees. Sifted’s Marketplace Intelligence tool offers detailed fee analysis, along with an automated FBA Audit, geographic sales visualization, and more seller insights.

3. Speedy Claims System

Finally, Amazon touts a claims system that will see most resolved within 24 hours. This is a far faster turnaround than the main carriers, or even other Amazon services, offer. The promise of fast, hassle-free claim resolution could be a welcome change from the auditing process most shippers are used to.

Is There a Reason for Amazon Shipping’s Timing?

This isn’t a “launch” of Amazon Shipping. It’s a re-launch.

The eCommerce giant originally shared plans for the service in 2020. Then a global pandemic unfolded. eCommerce surged, parcel volumes swelled, and facing capacity constraints, Amazon paused the program. Amazon didn’t cite a clear reason for the decision, though experts believed the surge in volumes led them to prioritize their own shipments over third-party packages.

The pandemic’s unprecedented surge in eCommerce volumes led Amazon to double the size of their fulfillment network. As shipping volumes normalized back to pre-pandemic levels, Amazon suddenly found itself with excess volume. “We currently have some excess capacity in the network that we need to grow into” CFO Brian Olsavsky said in a 2022 Q1 earnings call.

Capturing a share of the parcel market is a lucrative opportunity, but the timing of the relaunch is most likely driven by an immediate need to fill excess capacity. The deferred service times of 2-5 days would support this theory, as Amazon is showing a reluctance to dedicate their fastest, most prioritized deliveries to Amazon Shipping packages. For now, they’re trying to fill up empty space in trucks.

Still, that doesn’t mean they won’t be aggressive in growing their customer base.

How Aggressive Will Amazon Shipping’s Growth Be?

Carrier and delivery services are estimated to be a $163 billion industry in the U.S. Winning even a fraction of market share from FedEx or UPS could earn any carrier major profits. And Amazon is the most well-positioned to do it.

The industry hasn’t seen an entry to the market quite like this since DHL’s first attempt at entering the U.S. market, which failed and led to an eventual 10-year exit from the U.S.

Unlike DHL, Amazon has a diverse portfolio of revenue streams. Amazon Web Services (AWS) alone generated over $23 billion in operating profit in 2022. It’s possible that Amazon uses profits from their other branches to supplement Amazon Shipping, operating it at a loss to gain initial market share, before adjusting pricing.

Another advantage Amazon has? Brand recognition..

Many believe that lack of recognition of regional carriers may be slowing their adoption. Regardless of the quality of service they could provide, shippers may prefer their customers to see a familiar name, such as FedEx or UPS, when selecting a shipping option at checkout. Amazon, however, has built their own reputation for fast, reliable delivery. This fear won’t be a factor for Amazon Shipping.

While some view the eligibility requirement of selling on Amazon as a limitation, it’s worth noting that 1.9 million businesses sell on Amazon. The potential customer base is not small.

What Businesses Are a Fit for Amazon Shipping?

Though we believe Amazon Shipping will make them a major competitor to FedEx and UPS, it will take some time. In the beginning, they’ll have a hard time attracting enterprise-level shippers, as it’s a process for them to adjust their systems and divert massive amounts of volume to a new carrier.

We expect Amazon Shipping’s early iterations to be very attractive to small and medium-sized businesses (SMBs). It’s easier for them to move volumes, and many feel frustration with FedEx and UPS’ constant cost increases.

SMBs should be attractive to Amazon too, as they represent some of the highest margins in shipping. A network of more, lower-volume partners could give them the volume flexibility they’re seeking, if the theory that their main initial objective is to fill excess capacity is true.

A Major Player in the Carrier Market

The relaunch of Amazon Shipping will be remembered as a watershed moment in the world of parcel delivery. While the initial rollout is limited, the service’s potential impact on the broader eCommerce and shipping landscape cannot be underestimated. With its promise of competitive pricing, simplified fee structures, and a strong focus on customer satisfaction, Amazon Shipping is poised to attract a range of shippers seeking to diversify their carrier mix.

Shippers seeking to diversify need to consider a number of factors before making a switch. A Logistics Intelligence solution like Sifted can help with that decision. Once a new carrier has been implemented, the carrier management suite ensures you’re making the most of your multi-carrier mix.

Amazon Shipping has a long way to go before the FedEx/UPS duopoly can be considered a triopoly.

Still, the opening shot has been fired. And it’s a loud one.