3, 2, 1… blast off! Into 2023 we go! Let’s take a peek into what the future holds.

Heading into 2023, there’s still a lot of uncertainty for shippers. Inflation remains stubbornly high, consumer spending has slowed on non-discretionary categories, and FedEx and UPS recently announced a 6.9% General Rate Increase (GRI)—the highest in both companies’ histories.

However, amidst these troubling trends, there is also some good news. Fuel costs have come down, and gross domestic product rose 2.6% in the third quarter, which was higher than expected. Despite high inflation, U.S. consumers are in a better financial position than they were before the pandemic, having added more than $4 trillion to their savings since late 2019, according to McKinsey & Company.

This mixed bag of economic news means that there are reasons for businesses to maintain optimism in 2023, but that it’s also more critical than ever to be prepared for economic and business challenges. They could impact your shipping operations and, ultimately, your profit margins.

To help you understand where the greatest threats and opportunities lie in 2023, we’ve dug into approximately $20B in transportation data we’ve collected. This report shares top 2023 supply chain trends and how your business can adapt to survive and thrive throughout the next year and beyond.

Top Supply Chain Trends for 2023

Trend #1. Shipping Demand Has Normalized

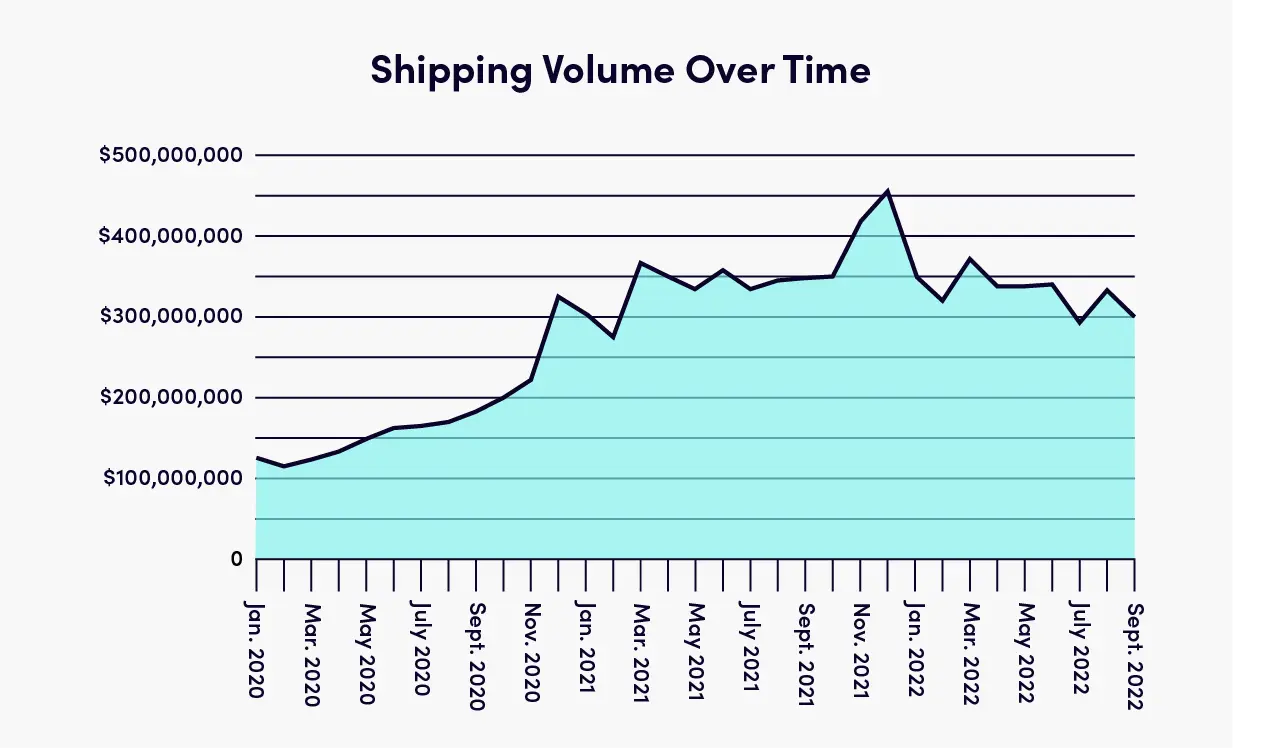

Since April 2022, shipping volume has been down almost 7% from last year. FedEx has seen a 9.6% decrease, while UPS has realized a 3.4% decrease. Carriers may be positioning some of this decreased volume as a sign of economic headwinds slowing shipping down, but our data indicates that rather than a slowdown, the reduced volume is more of a normalization back to pre-Covid shipping levels (see Figure 1).

Our perspective aligns with data from the International Monetary Fund (IMF) that indicates that though the latest online share of spending is higher than before the pandemic started, it’s only 0.6 percentage points above the growth trend for eCommerce before the pandemic. Now that it’s safe to do so, more consumers are shopping in-store again, reducing shipping demand.

Figure 1. Shipping volume for FedEx and UPS from 2020 to 2022. Sourced from Sifted.

Trend #2. Accessorials and Surcharges Continue To be a Target for Increases

While the announcement of a 6.9% GRI was higher than hoped, that’s just the tip of the rate increase iceberg. From 2020 (pre-Covid) to 2023 (post-Covid), carriers have increased accessorial and surcharge fees by a staggering 20% to 30%. For many of our customers, this means their actual year-over-year shipping rate increases are in the double digits (see Figure 2).

The exorbitant increase in accessorial fees indicates that efficiency is a priority for both carriers. Remote deliveries and oversize packages are not efficient or lucrative. They can no longer afford to absorb those costs and are now passing them back to shippers.

Figure 2. FedEx and UPS surcharge increases between 2020 to 2023. Sourced from Sifted.

Trend #3. On-Time Delivery and Performance Are Getting Better

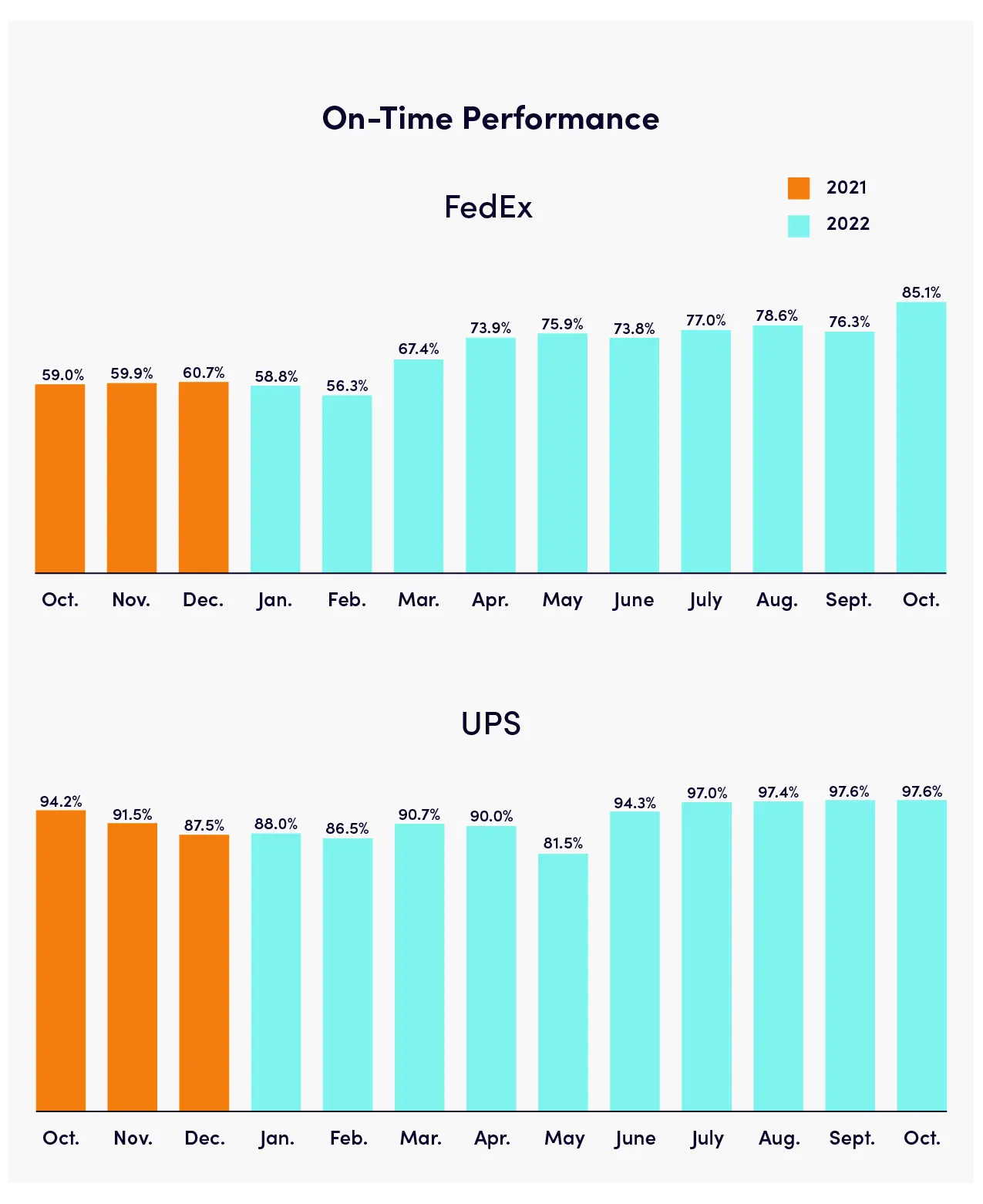

Shippers in early 2022 saw carriers’ on-time delivery and performance drop to historic lows. FedEx’s performance ratings declined to 56.3% in February 20221. However, they are now up more than 28%, with on-time performance hovering around 85% as of October 2022.

While UPS’s on-time performance has remained consistently higher than FedEx’s, they have also struggled to meet their standard performance levels. In May, UPS’ on-time performance dropped to 81.5%. Today, it’s back up to 97.6% (see Figure 3).

The normalization of demand is one of the biggest factors in carriers’ significant improvements in their on-time delivery rates. However, despite on-time performance returning to pre-pandemic norms, carriers have not added back service guarantees that were rolled back during the pandemic. Unfortunately, we don’t anticipate they will reinstate these guarantees, as they were a significant expense, and FedEx still has network issues and labor challenges to resolve. While UPS has fewer challenges to contend with, they are unlikely to act unless FedEx does.

Figure 3. FedEx and UPS On-time performance 2021-2022. Sourced from Sifted.

Trend #4: FedEx and UPS Face Labor Turmoil

The UPS-Teamsters contract, which typically runs five years, is North America’s largest collective bargaining agreement. The current contract expires on July 31, 2023. How these negotiations go could significantly impact UPS and its customers. With high inflation, supply chain challenges and more bargaining power than the Teamsters have had in a long time, those leading the negotiations have said they will strike if an agreement isn’t reached by August 1, 2023.

While a strike remains unlikely—it’s not out of the question. In 1997, UPS drivers were on strike for 15 days and stopped delivering 80% of their shipments. UPS lost $780 million. In today’s eCommerce-driven environment, a strike would be even more damaging to UPS and its customers.

Meanwhile, FedEx has its own challenges with missed quarterly targets and independent contractors complaining that high fuel costs, labor, and new vehicles make it unprofitable to continue to deliver for FedEx. Unless FedEx agrees to change contractor compensation, some contractors are also threatening to strike.

Trend #5: Economic Uncertainty Will Remain for 2023

The global economy continues to be battered by multiple shocks, and businesses should prepare for continued volatility over the next year. While no one can predict a recession, the short-term outlook is that the global economy is weakening rapidly. Even if the U.S. or the world avoids a recession, we’ll likely see a significant slowdown in growth in 2023.

For businesses, this means consumers may be wary of spending. If shipping costs remain stubbornly high, this may deter consumers from purchasing or push them to make more in-store purchases.

How Shippers Can Adapt to 2023 Supply Chain Trends

“People are expecting quick transit times and low costs. Unless businesses can change their network and the way they ship, it will be a difficult 10 years ahead.” –Kevin Miller, VP of Data Science at Sifted

Our data revealed that key areas like on-time performance and reduced package volumes should make some aspects for shippers a little easier in 2023. Shippers can feel more confident that carriers can meet their shipping demands. They can also feel more confident in providing shipping timelines to customers and that packages will arrive as expected.

However, these positives are weighed down by the very real concerns shippers have with the skyrocketing shipping price inflation, labor shortages, high fuel prices, and a limited choice of carriers. At the same time, consumers continue to expect fast transit times at a low cost. Meeting consumers’ expectations and dealing with high shipping costs can leave some shippers with an unprofitable business model.

“Thinking outside the box has to be the new norm. If not, you will price yourself out of product profitability,” notes Caleb Nelson, Chief Growth Officer at Sifted.

What does thinking outside the box look like? Here are our top 5 suggestions:

1. Diversify Your Carrier Mix

Shippers can no longer rely on one carrier. Diversification of carriers will reduce risk and help lower costs. The new transcontinental offering by LaserShip-OnTrac provides more diversification opportunities for shippers as they continue to expand their footprint across the U.S. with the ability to now reach 74% of the U.S. population across 30 states and Washington, D.C.

2. Optimize Your Distribution Network

Shippers should also look for solutions outside the norm, such as creating partnerships with fulfillment centers, using brick-and-mortar locations, and evaluating and optimizing their distribution footprint to ensure that packages are shipped as close to the destination as possible. This aids in faster transit times and can lower costs by limiting the need to pay for next-day or two-day shipping.

3. Eliminate Package Inefficiencies

Avoiding oversize and dimensional weight surcharges will be critical to reducing shipping costs. A logistics intelligence platform like Sifted gives you the power-control to make effective changes within your packaging operations by optimizing your box sizes and carrier service levels to help you get packages to customers in the most efficient, cost-effective manner.

4. View Your Carrier as an Ally

Talk to your carrier representative. They are your partners. They are there to make it work for you and their company. While carriers aren’t able to be as flexible as in the past with discounts, they may have other ideas. The more data you have about where you’re getting hit with high fees, the better you’ll be able to make your case and work with the carrier to find the best solution.

5. Centralize and Analyze Your Shipping Data

Having your shipping data in a logistics intelligence platform like Sifted gives you visibility into carrier rates, accessorial fees, and performance. This data is necessary to intelligently negotiate your contract with your carrier to get the best overall rates for your business. Likewise, your shipping data can help you identify hidden costs in your shipping operations—whether that’s bad addresses, inefficient packaging, poor network distribution, or not optimizing your service levels.

Get Visibility Into Your Operations Now

Data Is the Key for 2023 Supply Chain Trends

Despite the current economic challenges and high cost of shipping, it’s critical to be able to control and plan for a worst-case scenario. If an economic slowdown does come, the last thing you want is to pay the most you’ve ever paid for shipping services, especially when they are a fundamental piece of your business—and one of your largest expenses.

The good news is that as a shipper, you have more options than you may believe, both in negotiation and internal improvements to reduce cost. But you need data to know where you can make impactful improvements and where you need to negotiate with carriers.

Shippers that plan to survive and thrive in 2023 are being more sophisticated in their strategy approach. When you use your shipping data intelligently, through a solution like Sifted, you get the visibility and insight to know which levers to pull to reduce your shipping costs.