The 2023 GRI has now been released by UPS & FedEx- 6.9%! View our analysis to get the full breakdown of rates and sight into what your actual impact will be.

Inflation, labor shortages, high fuel costs, and unprecedented demand for shipping capacity will all play a role in the 2023 general rate increase (GRI). It continues to be a carrier’s market. And they have the upper hand when setting rates for 2023.

The big question on everyone’s mind isn’t whether rates will go up – but just how bad will it be?

With years of experience tracking the general rate increase and analyzing billions of shipping data points, Sifted uses today’s data to forecast future insights into the world of shipping. This expertise gives us a unique perspective on what FedEx and UPS will likely do regarding this year’s GRI.

Here’s our best guesses on what to expect for the 2023 GRI based on our data and expertise, plus how to prepare for higher shipping fees—while staying profitable.

Prediction #1: Base rates will equal or exceed last year’s increase

The historical average of a 4.9% net increase for the GRI base rate is ancient history.

Last year, FedEx and UPS broke the mold with a 5.9% increase. This year we expect to see more of the same. In fact, the 2023 general rate increase has the potential to far exceed last year’s base increase, with fuel surcharges, inflation, and labor costs weighing heavily on carriers’ financial wellbeing.

Why are we anticipating such a significant increase?

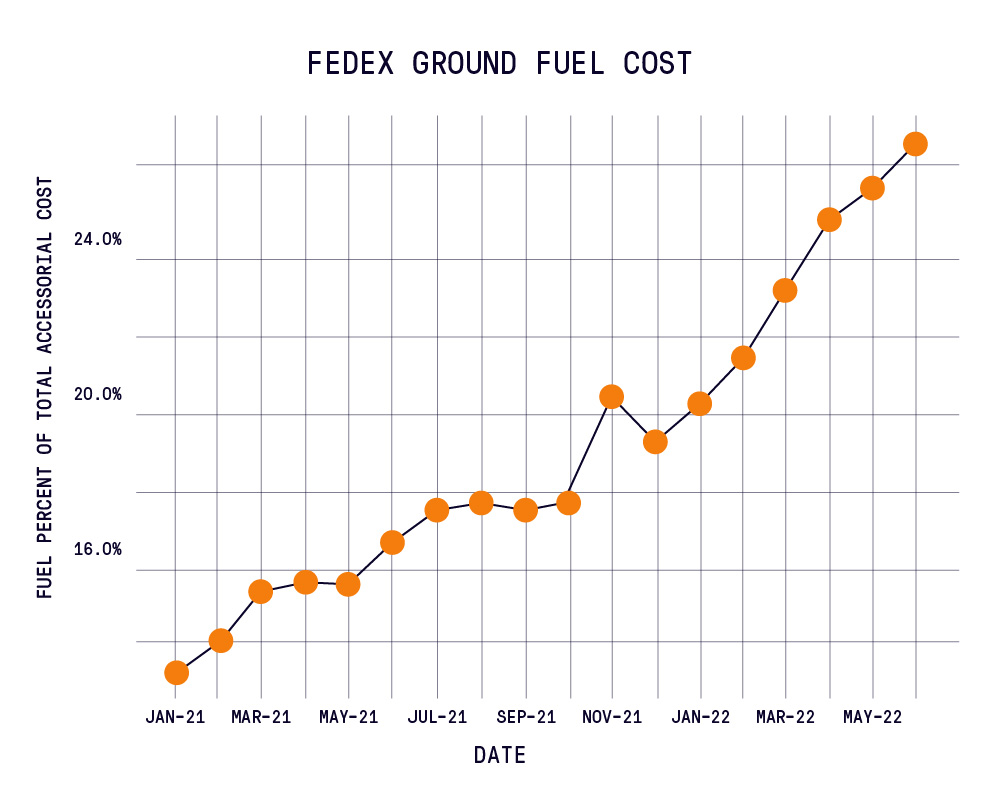

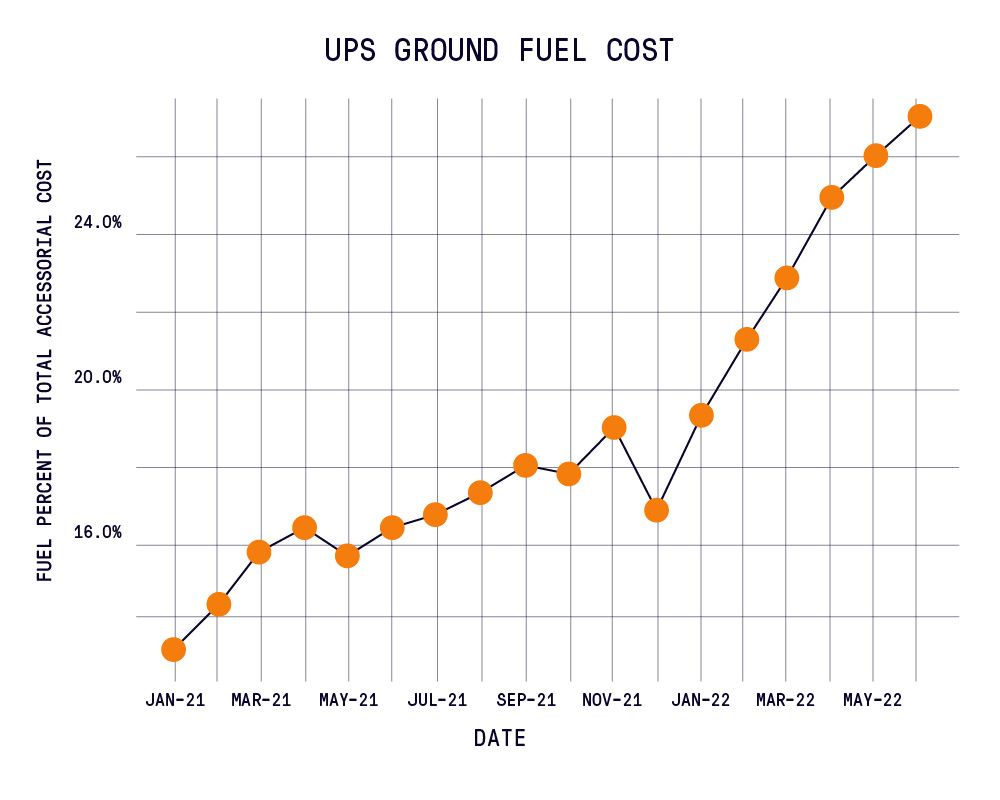

Fuel surcharges alone have increased dramatically. And for a decade now, fuel prices have held steady at 7% to 8%, but they’ve risen sharply in the last year. As of August 2022, they were hovering near 20%. Fuel costs have become so volatile, carriers are adjusting the rate on a week-to-week basis.

Additionally, FedEx continues to face labor shortages that require increased wages to mitigate. There is also a UPS contract negotiation in 2023 with the union, and it’s nearly certain that higher labor costs will be part of the renegotiation. Inflation also continues to impact everyone’s bottom line – including carriers.

We’re in uncharted territory when it comes to predicting next year’s base rate hike, but we expect to see a new era of a net average GRI in the 6% range.

The good news, if you want to call it that, is that it’s unlikely either carrier will go as high as 7.9% for parcel, which was the increased rate for customers last year who used FedEx freight shipping FXF 1000 and 501.

Fuel volatility is on the rise

Prediction #2: Increased accessorial fees will have the biggest impact on shipping costs

While we anticipate FedEx and UPS surcharges will increase in the base GRI significantly, we also expect they’ll use accessorial fees as an easy and quick way to add revenue.

One trend expected to continue in 2023 is carriers bringing more shipments into the oversized category—subject to additional DIM fees. In 2017, we saw the DIM length calculation go from 60 to 48 inches. In 2021, carriers added the addition of length plus girth should not exceed 139 inches. In 2023, we expect to see further shrinkage of the DIM.

We also anticipate additional parameters on what defines “additional handling fees.” These new standards will make the requirements to avoid these fees more difficult. Finally, we believe zone-based pricing increases are likely, raising costs the further it goes.

Last year, surcharges averaged double-digit increases for our customers. Shippers must carefully examine the impact of any changes in surcharges or accessorial fees and understand the consequences to the business and what can be done to mitigate it.

Prediction #3: Residential last mile deliveries will be a prime target for increased fees

Record growth in eCommerce shipping has been occurring for some time. Covid only accelerated the trend. Last year, FedEx dissolved its partnership with the United States Postal Service (USPS) to increase its residential delivery density and make it more efficient. However, residential deliveries remain the most costly and inefficient type of delivery for both carriers.

B2B shipments are much more efficient. Carriers can deliver a large number of packages to predetermined stops. They can also pick up items for shipping at the same time. For example, an electronics manufacturer may consistently receive daily or bi-weekly deliveries of electronic components they need to build their products. At the same time, the carrier can pick up finished products for shipping.

Given the expense and inefficiency of residential deliveries, we expect carriers will continue to increase fees associated with these types of deliveries.

How to combat an increasingly hostile shipping environment and remain profitable

There’s no sugarcoating the news. Shipping rates are rising, and maintaining profitability in today’s current shipping environment is a concern for almost every business.

To ensure continued profitability, visibility into your shipping operations is critical. Closely evaluate your business’ shipping operations to understand what you can afford to offer customers – and what costs your customers will have to absorb.

Take a look at efficiencies across every aspect of your shipping, including:

- Packaging: Know which packages will be hit with additional handling fees and take all possible steps to reduce package size and weight to meet DIM requirements and avoid additional fees.

- Network distribution: Gain visibility into what zones you’re shipping to most frequently to see where you can reduce zone-based shipping costs by locating more products closer to more customers.

- Free and fast shipping: Calculate the total landed cost of shipping a product to find when you can offer free or fast shipping and when customers will need to pay more for these services.

- Carrier mix: Diversify your carrier mix to help bring down costs. FedEx and UPS are both looking for quality over quantity in their business. If you’re unhappy with your current carrier contract because of performance or fees, you may be unable to switch between the two carriers. However, more regional carrier choices are available than ever before, allowing you to diversify your carrier mix to create a multi-carrier shipping network that will lower shipping costs and improve performance.

The details are in the data

Visibility alone won’t get you in front of the GRI this year. You need to know how to quickly analyze your shipping data.

Given that the GRI announcement has been increasingly bumped back to later in the year, you may have very little time until rates go into effect, making it imperative that you can quickly understand the impact and mitigate it.

When you have your data in a system like Sifted, you can easily use your historical shipping data to get a detailed analysis of how much the general rate increase will impact your shipping costs – and where those impacts will be most significant. This gives you the power to make profitable and confident changes quickly.

Don’t wait until the GRI is announced to do something about it. Sifted can help you prepare and predict what’s coming. Get a free analysis of your shipping data today.